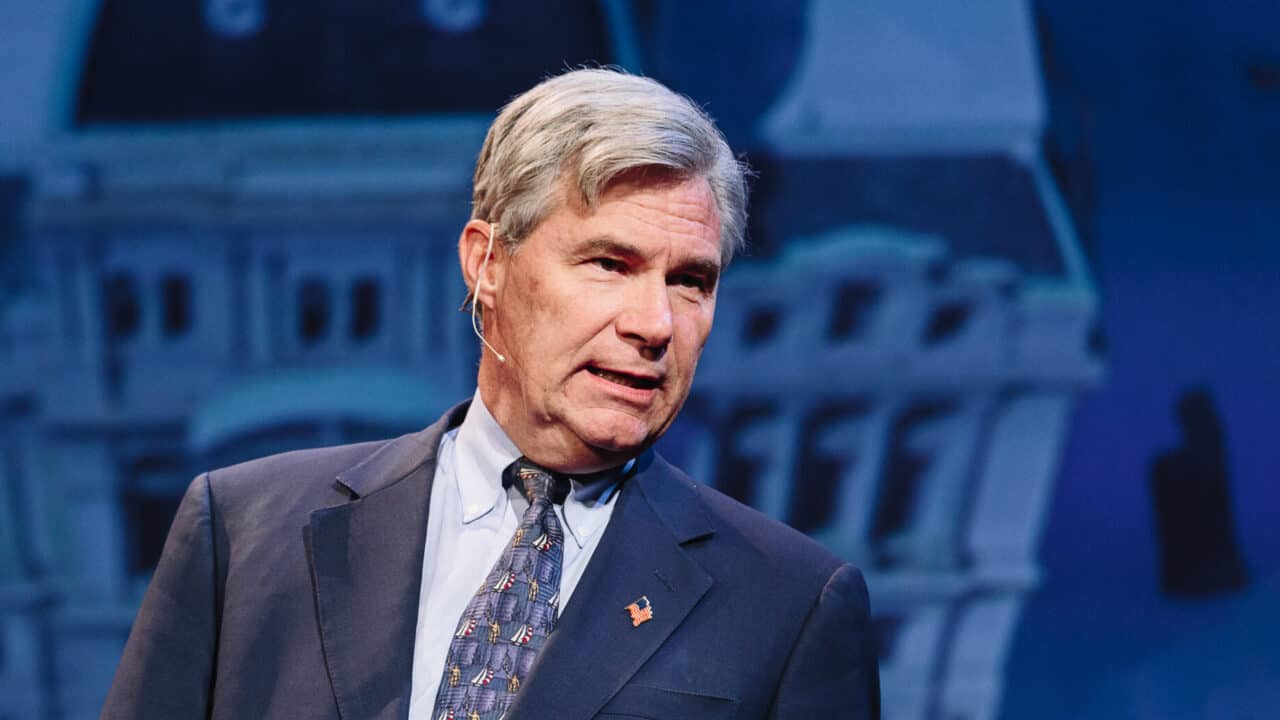

"Senator Sheldon Whitehouse. TEDx Providence 2017" by TEDx Providence is licensed under CC BY-NC-ND 2.0. https://flic.kr/p/YMNmYd

"Senator Sheldon Whitehouse. TEDx Providence 2017" by TEDx Providence is licensed under CC BY-NC-ND 2.0. https://flic.kr/p/YMNmYd

The Cramer-Coons-Whitehouse “PROVE IT Act” (S.1863) will allow politicians to later saddle Americans with carbon taxes and tariffs, imposing an even higher cost burden on households and businesses.

It is no coincidence that the co-sponsors and supporters of S.1863 have a history of supporting carbon taxes and tariffs and a “price on carbon.” The bill is the key first step in imposing the tariffs and taxes, but they would prefer you did not think about that right now as they try to get it passed.

As noted by the Washington Post, the legislation is “a bill that would lay the groundwork for America’s first carbon border tax.”

When more than 40 conservative groups this week opposed the bill and warned the bill would pave the way for carbon tariffs and carbon taxes, Sen. Cramer tried to deny it and then attacked the conservative groups.

You can see why he might be sensitive about this given the pro-carbon-tax habits of the people and groups supporting the bill, not to mention Sen. Cramer’s own past endorsement of a domestic carbon tax.

Let’s go through the list of co-sponsors and groups trying to impose S.1863:

Climate Leadership Council wants to impose a carbon tax. The group notes the bill will “pave the way for a carbon border adjustment mechanism in the U.S.” This group was founded in 2017 with the organizational mission of lobbying Republicans to pass a carbon tax.

Third Way wants to impose a carbon tax. The group touts the PROVE IT Act as a “bill that will lay the groundwork for America’s first carbon border tax.” In fact the group even complains that existing carbon taxes in other nations are too low. [Link]

Citizens for Responsible Energy Solutions endorsed a carbon tax.

Sen. Chris Coons (D-Del.) wants to impose a carbon tax. He has sponsored carbon tax legislation and speaks about the issue frequently.

Sen. Sheldon Whitehouse (D-Beach Club) wants to impose a carbon tax. He recently noted Cramer and Coons continue to “work toward a carbon border tariff.”

Sen. Kevin Cramer (R-N.D.) in 2015 endorsed a carbon tax during an event with National Journal. He confirmed that position in an interview with Politico, describing it as “a modest carbon tax on all emitters.” Politico quoted him as saying his carbon tax is “the type of thing that could catch on and get some momentum if people are serious.” Cramer now hopes taxpayers and his constituents will kindly forget about that incident.

Sen. Dick Durbin (D-Ill.) wants to impose a carbon tax. He has sponsored carbon tax legislation.

Sen. Lisa Murkowski (R-Alaska) wants a “price on carbon.” [Link]

Sen. Lindsey Graham (R-S.C.) wants a “price on carbon.” He said: “When you put a price on carbon, everything else works.” [Link]

Sen. Bill Cassidy (R-La.) is currently a co-sponsor of legislation to impose a carbon border tax. [Link]

It is no coincidence that “PROVE IT Act” proponents are also Washington’s biggest pushers of carbon taxes. Taxpayers beware.

See also: Sen. Cramer’s Energy Tax Would Hit the Poor, the Old, Those on Fixed Incomes